Our systematic macro portfolio combines a range of investment concepts applied across the most liquid asset classes, aiming to construct a diversified mix of rule-based strategies that are complementary across time horizons and designed to perform cohesively over the long term.

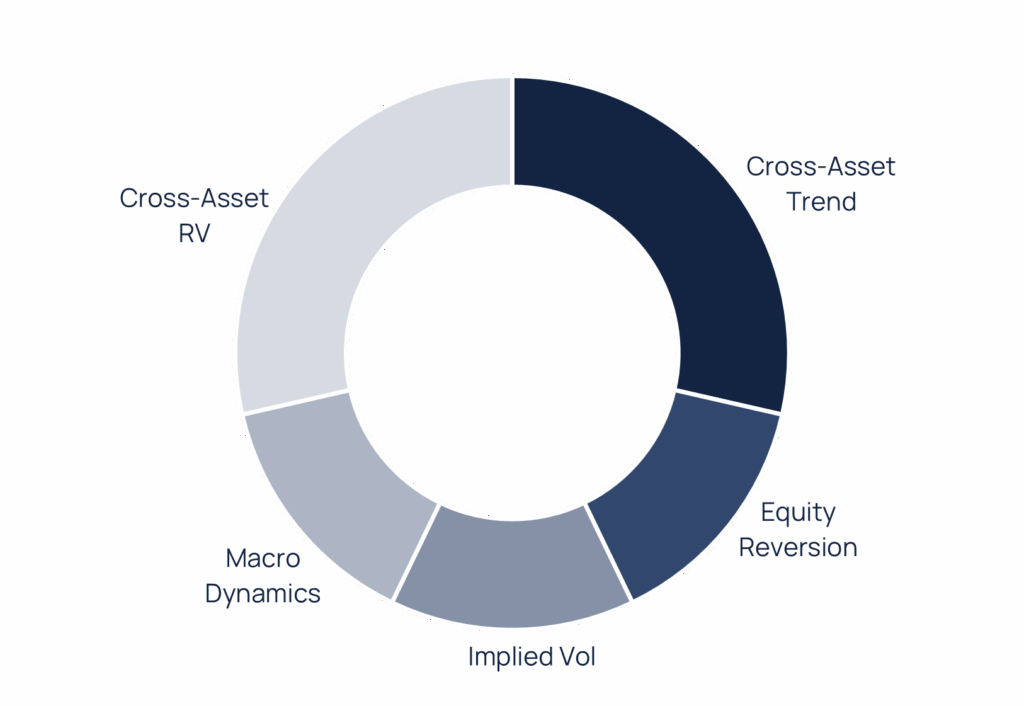

Key strategy components include, among others:

(*) Source: Bainbridge This graph has been provided for illustrative purposes only and should not be relied upon in making any investment decision.

2025 Bainbridge Partners © All rights reserved.

Bainbridge Partners LLP is authorised and regulated by the Financial Conduct Authority to provide investment services to qualified investors.

Bainbridge Partners LLP is registered in England, no. OC341436, registered office Montpelier House, 106 Brompton Road, 5th Floor, London, SW3 1JJ