While investors have multiple options when it comes to hedging their Equity portfolios, most traditional protection strategies suffer from a key drawback: performance decay in rising markets. Our approach seeks to address this challenge by offering a persistent and adaptive hedging solution.

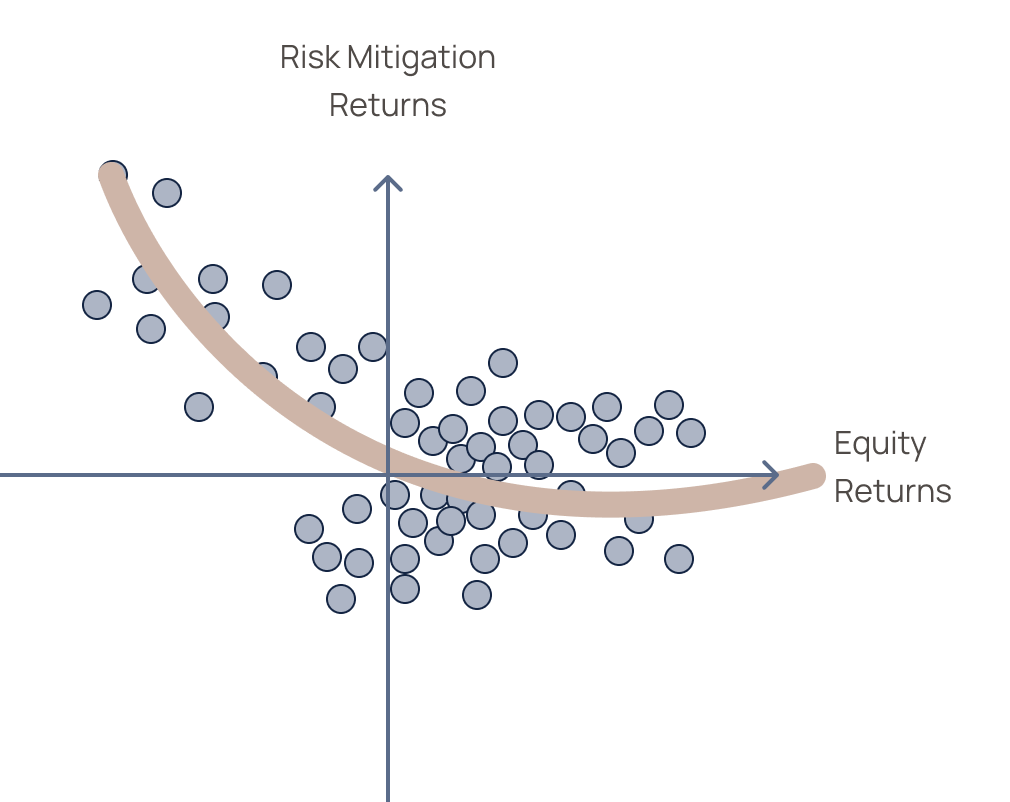

Our risk mitigation strategy leverages tailored elements from our broader strategy set, re-engineered to offer a persistent negative correlation to Equity markets.

Key objectives include:

(*) Source: Bainbridge This graph has been provided for illustrative purposes only and should not be relied upon in making any investment decision.

2025 Bainbridge Partners © All rights reserved.

Bainbridge Partners LLP is authorised and regulated by the Financial Conduct Authority to provide investment services to qualified investors.

Bainbridge Partners LLP is registered in England, no. OC341436, registered office Montpelier House, 106 Brompton Road, 5th Floor, London, SW3 1JJ