Our Equity Market Neutral portfolios—whether discretionary or systematic, fundamental or quantitative—span different trading horizons. They aim to generate returns by capturing cross-sectional dispersion among individual stocks, while maintaining low exposure to both market direction and common risk factors.

While managed by different teams, they all share the same key objectives:

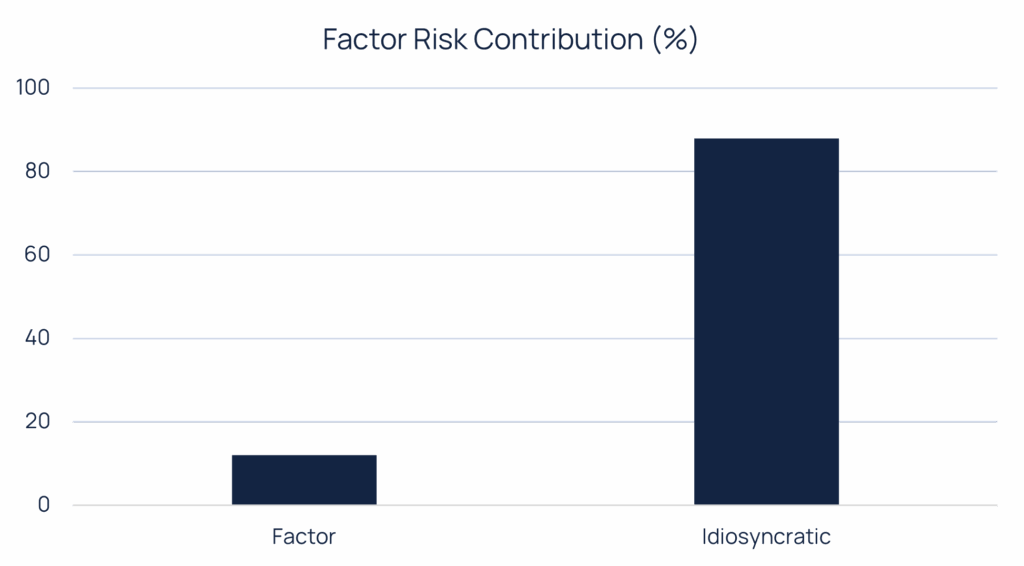

(*) Source: Bainbridge This graph has been provided for illustrative purposes only and should not be relied upon in making any investment decision.

2025 Bainbridge Partners © All rights reserved.

Bainbridge Partners LLP is authorised and regulated by the Financial Conduct Authority to provide investment services to qualified investors.

Bainbridge Partners LLP is registered in England, no. OC341436, registered office Montpelier House, 106 Brompton Road, 5th Floor, London, SW3 1JJ